Hey good people! Charles here, and I've got some juicy news for you this week! So buckle up, let's dive into whats going on in the world of crypto.

Robert Kiyosaki: Fed Reserve Is Destroying Regional Banks and Could Nuke the American Economy First up, Rich Dad Poor Dad author Robert Kiyosaki is sounding the alarm on the Federal Reserve's tight monetary policies. He's not holding back, claiming that the Fed is squashing regional banks across America, including Signature Bank, Silicon Valley Bank, and First Republic. And that's not all - it's also causing big names like Amazon to lay off staff. Robert fears the Fed could trigger hyperinflation and a depression, leaving us with war, starvation, and a destroyed middle class. As he puts it: "WTFed is not our friend... the Fed is the dark side". So, brace yourselves - the Fed might be about to wreak some serious havoc on the American economy. (Read more: https://dailyhodl.com/2023/04/29/federal-reserve-is-destroying-regional-banks-and-will-nuke-american-economy-robert-kiyosaki/)

It's the End of an Era: US Dollar Losing Its Global Dominance On the international front, Russian foreign minister Sergey Lavrov is claiming that a global currency flip is going to turn the financial landscape upside down. The US dollar's reign as the world's top currency might be over, and there's nothing America can do to stop it. China and Russia are already leading the charge, with their currencies being increasingly used for international transactions. The Chinese yuan even surpassed the dollar as the most widely-used currency for China's cross-border transactions this week. So, hang on to your hats, folks - the US dollar's about to get rocked. (Read more: https://dailyhodl.com/2023/04/29/global-push-to-ditch-us-dollar-is-now-unstoppable-says-russian-foreign-minister-sergey-lavrov/)

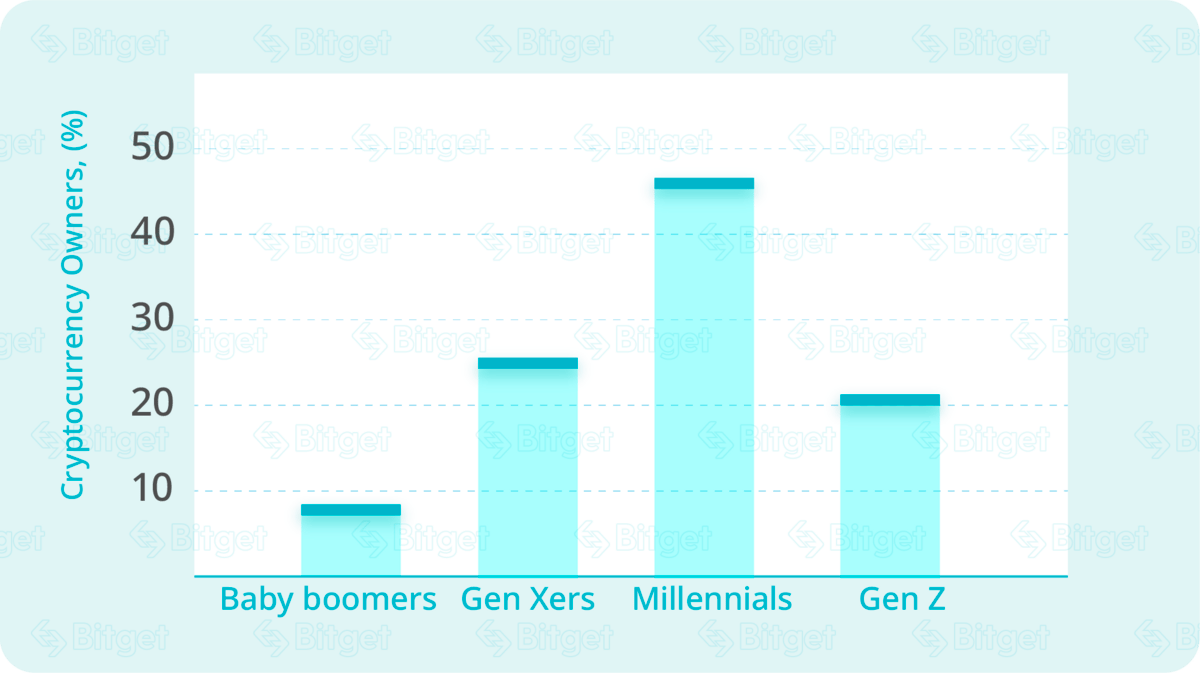

Millennial Crypto Craze: 46% of Millennials In Major Economies Own Crypto Crypto is becoming more popular across generations. A new survey by Bitget found that a whopping 46% of Millennials in the 26 surveyed countries own crypto. This trend is likely driven by their wide knowledge of the internet and modern technologies, as well as investors having made substantial returns since 2017. Meanwhile, around 25% of Gen Xers, 21% of Gen Zs, and 8% of Baby Boomers also own crypto. Charles Schwab even found in a separate survey that more Millennials and Gen Zs want to add digital assets to their 401(k) plans. With more and more people getting involved in crypto, it's only a matter of time before the whole world jumps on the bandwagon. (Read more: https://bitcoinist.com/research-shows-millennials-major-economies-crypto/)

SEC Got Slapped in the Face with XRP Lawsuit — Law Professor Says They Underestimated Ripple J.W. Verret, law professor from George Mason Law School, commented on the ongoing XRP lawsuit and the SEC's move against Ripple. Verret praised Ripple's defense team, particularly CEO Brad Garlinghouse, for their determination to fight back. He also suggested that the case might be taken to the Supreme Court of the US, potentially providing clarity on the crypto industry's regulatory uncertainty. Garlinghouse said that Ripple's legal expenses, which could exceed $100 million by the time the lawsuit is over, are worth it. Verret predicts the case to wrap up in the district court soon, whether Ripple wins or loses. Could this whole ordeal be the SEC's comeuppance?? (Read more: https://zycrypto.com/xrp-lawsuit-the-sec-underestimated-ripple-asserts-law-professor-heres-why/)

Mastercard Goes All-In on Crypto, Launching Solution to Reduce Bad Actors Global financial services giant Mastercard has announced a Web3 solution to verify transactions, verify users, and reduce the opportunity for bad actors. The solution, called Mastercard Crypto Credential, lets users get a unique identifier from Mastercard, allowing the company to quickly revoke certification if the user is found engaging in nefarious activity. Mastercard has also announced partnerships with wallets Bit2Me, Lirium, Mercado Bitcoin, and Uphold, as well as blockchains Aptos, Avalanche, Polygon, and Solana. This latest move is part of Mastercard's big push into the crypto sector, which includes a new NFT-gated musician accelerator program with Polygon and a stablecoin payments-focused project announced by Visa earlier this week. Crypto is becoming pretty mainstream! (Read more: https://cointelegraph.com/news/mastercard-launches-web3-user-verification-solution-to-curb-bad-actors)

Here Comes the Crypto Legislation Train Good news from Rep. Patrick McHenry and Sen. Cynthia Lummis, two bipartisan lawmakers from the U.S. House of Representatives and the U.S. Senate, respectively. They announced at the Consensus conference that legislation to regulate the crypto industry is coming soon. McHenry said the House Financial Services and House Agriculture Committees would have a bill ready in the next two months, with the potential for it to be signed into law by President Biden within the next 12 months. Lummis mentioned a new-and-improved version of their Responsible Financial Innovation Act could be released in the next 6-8 weeks, featuring a stronger cybercrime aspect and a focus on national security. The bill is expected to use the Howey Test, a longstanding framework for determining whether certain transactions qualify as “investment contracts” and thus fall under the purview of securities laws. With the EU leading the way with their Markets in Crypto Assets (MiCA) law, and countries like Japan, the UAE, and Hong Kong making progress towards regulating their crypto economies, the U.S. needs to get its act together or risk losing the crypto race! Congressional hearings, discussion drafts, and new bills suggest the train is about to depart - don't miss your chance to hop on board! (Read more: https://www.coindesk.com/policy/2023/04/28/us-house-will-have-crypto-bill-in-2-months-mchenry/?utm_medium=referral&utm_source=rss&utm_campaign=headlines)

Crypto War: On! Blockchain Association CEO Smith Declares War Against Gensler, Warren The crypto industry isn't backing down against regulators. Kristin Smith, Blockchain Association CEO, declared during a panel at Consensus 2023 that the crypto industry is "absolutely at war" against Gary Gensler, Chairman of the Securities and Exchange Commission, and Senator Elizabeth Warren (D-Mass.). Despite their anti-crypto stances, the blockchain industry is vigorously fighting against the regulators. According to Smith, lobbying and education efforts by pro-crypto groups halted Warren's bill and caused her to lose co-sponsors. So, it's war, not a battle! Crypto folks, hunker down and giddy up! 🤠 (Read more: https://www.coindesk.com/policy/2023/04/28/crypto-industry-is-absolutely-at-war-against-gensler-warren-blockchain-association-ceo-smith-says/?utm_medium=referral&utm_source=rss&utm_campaign=headlines)

The Big 3: Polkadot ($DOT) & Friends Lead in Crypto Development Activity Polkadot ($DOT) is leading the pack when it comes to development activity, according to data from on-chain analytics firm Santiment. Kusama ($KSM) and Cardano ($ADA) are holding it down in second and third place, respectively. The term “development activity” refers to the amount of work completed by a project’s developers on the project’s public GitHub repositories within the past 30 days. Polkadot and KSM have been stepping it up over the past few years, while ADA has been (surprisingly) playing it cool but still maintaining a high level of activity. This could be a sign that DOT and company ain't no exit scam. With the launch of its main blockchain, the Relay Chain, Polkadot is becoming a formidable ecosystem that stands to compete with other smart contract networks like Ethereum, BNB Chain, and more. The future is looking mighty bright for DOT holders, who have the power to stake their tokens and control the future of the network by voting on upgrades. (Read more: https://www.cryptoglobe.com/latest/2023/04/polkadot-dot-kusama-ksm-and-cardano-ada-dominate-in-crypto-development-activity-data-shows/)

Polygon Gets 'Cloudy' With Google, Coins Hop on the MATIC Train Polygon just partnered up with Google Cloud, a move that's sure to get more folks talking about their core protocols. Not only will Google Cloud provide its infrastructure and developer tools, it'll also integrate its own node hosting system into the Polygon ecosystem. That's on top of providing faster and cheaper transactions via their zero-knowledge proof system.

The news was met with a ton of enthusiasm in the MATIC fanbase and beyond. The coin was enjoying a 1.76% surge at press time. Not to mention, Polygon's daily unique addresses and daily volume in profits were both on the rise. But on the flip side, Open Interest (OI) in the futures market was waning. Guess not everyone is convinced that Google Cloud is gonna save the day. Who knows? Maybe it will. (Read more: https://ambcrypto.com/polygon-matic-forges-alliance-with-google-cloud-to-spruce-up-its-ecosystem/)

Alright, let's slip in a little advice for you all, speaking straight from experience at Crypto Asset Recovery. One of the best ways to keep your crypto safe and sound is by using cold storage devices like a Ledger (https://shop.ledger.com/) or Trezor (https://trezor.io/compare). I promise you - I've seen clients who could've saved themselves a whole lot of money had they been using one of these bad boys and taking the time to store it securely. Both of them are top notch and we’d recommend either one to any client of ours (although we personally take Ledger every time). If you're thinking of seriously getting into crypto, don't skip out on a hardware wallet.

So, there you have it, folks! The crypto world is buzzing with activity, from Ripple's record-breaking Q1 to the ongoing battle between the crypto industry and regulators. As the US dollar loses its dominance and more millennials hop on the crypto train, it's clear that the future of finance is changing. With global giants like Mastercard diving deeper into crypto and legislative progress on the horizon, it's only a matter of time before the whole world embraces the cryptocurrency revolution. Buckle up and enjoy the ride! 🚀